Indian rice exports have decreased by almost 60 percent in the first two months of the current prosecutor on loose demand. In the world rice market, prices continue to govern minimums of several years, and some of the buyers still have huge inventories, merchants and analysts.

“Rice exports have a low leg in the last two months (April and May).

Surplus supply

The situation was such that there was no room to download in January and there was too much load floating in the sea, he said.

“The record production of India and high actions keep global prices. With the supplies that exceed demand, pressure in the global market is exerted,” said New Delhi commercial analyst, S Chandrasekaran.

In the case of India, loose demand abroad is to count. The data show that Sanciledas (boiled) rice exports jumped from 4.35 Lakh Tons (LT) in September 2024 to 11.35 LT in October, 10.13 LT in November, 11.01 LT in December and 12.52 LT in April and 2.07 Ltpiping.

Similarly, white rice exports (raw) increased 6.91 LT in October 2024 of 30,000 tons in September. It also increased to 8.07 Lakh Tons in November before establishing around 6 LT in December and 5.22 Lt in January 2025. This fell to 3.04 LT in April 2025 and 2.92 LT in May.

Monthly shipments

This points to the general exports that fall from around 13 lt per month to a little less than 5 lt. “India exports 16-17 million tons (MT) or rice annually. This means 1.3 mt at 1.4 mt per month. What we are witnessing is a great testimony.

”

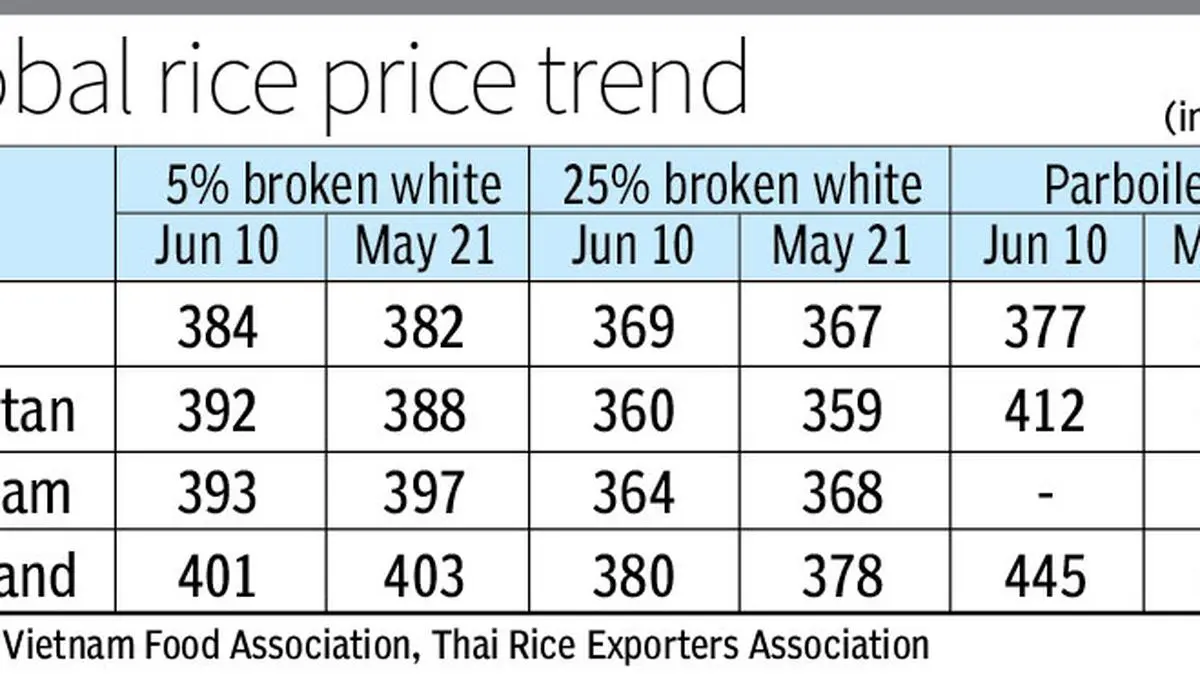

Currently, 5 percent broken white rice of India is governing at a minimum of five years of $ 384 per free ton (FOB). Parking rice is cited at $ 377 FOB, except for 25 percent broken white rice, India’s offer is the most competitive.

“Since February, FOB prices have dropped 20 percent and the net fall is 40 percent if you observe prices when India stopped exports,” Rao said.

Panic signal?

M MADAN PRAKASH, director of the Rajathi Group that exports agricultural products, said: “There are almost no consultations now. The demand is totally missing.”

“Floy demand seems universal. India reports a drop in exports. At the same time, its competitors do not report any increase in shipments,” said Chandrasekaran.

“The decline in rice exports continues until this day,” said Paharia.

Chandrasekaran wondered if the Indian Food Corporation (FCI) sent a panic signal of its bees of bees filled by the rice offer to the states and the production of ethanol to ₹ 22.50 per kg.

“It makes one wonder if FCI sent a signal to the global market that India is rasted from rice actions,” he said.

Bulky actions

As of June 1, FCI had record shares of 37.99 mt Rice and 32.26 mt or rice without calm (21.61 or rice). India had stopped rice exports in 2022 and 2023 when wheat production fell and the government thought that rice supplies may not have demand, which increased in wheat production problems.

However, since the second or 2024, rice stocks have bulky. This resulted in India to eliminate rice exports, even 100 percent broken rice. India also became the main rice producer in 2024-25, producing more than 149 TM.

Chandrasekaran said that neighboring countries such as Bangladesh have also reduced rice purchases from India. But Rao said Dhaka has always been buying rice inside and outside.

“Demand has not increased just after a price drop,” he said.

Chandrasekaran and Rao said that Indian rice exports may not touch 24 TM, as projected by the United States Department of Agriculture.

Posted on June 11, 2025